SaaS Capital in Cincinnati raises $101M for its fifth fund, supporting software-as-a-service companies with debt financing.

Software Financing: How SaaS Capital's $101M Fund Powers Growth

Software Funding: SaaS Capital Raises $101M for Fifth Fund!

Software Funding: SaaS Capital Raises $101M for Fifth Fund!

Software Funding: SaaS Capital Raises $101M for Fifth Fund!

Unlocking Growth for Software-as-a-Service Innovators

In a significant boost for the tech landscape, SaaS Capital, based in Cincinnati, has successfully closed its fifth fund, securing an impressive $101 million. This substantial capital injection is specifically earmarked to provide debt financing for promising software-as-a-service (SaaS) companies. For entrepreneurs navigating the complex world of startup funding, understanding how this new fund impacts the future of software development and scalability is crucial. This article delves into the implications of this major investment, exploring how it empowers SaaS innovators and reshapes the funding ecosystem.

SaaS Capital’s $101M Boost: A Game Changer for Software Growth

The announcement from SaaS Capital marks a pivotal moment, reinforcing the robust demand for flexible, non-dilutive capital within the rapidly expanding SaaS sector. This $101 million fund will directly support companies developing cutting-edge software solutions, helping them scale operations, accelerate product roadmaps, and ultimately, achieve market leadership without sacrificing equity.

Powering the SaaS Revolution with Strategic Debt Financing

Unlike traditional venture capital, which involves selling off a piece of your company, debt financing offers a different path. It’s a loan that needs to be repaid, often with interest, but it allows founders to retain full ownership and control of their vision. For high-growth SaaS businesses, this model is becoming increasingly attractive.

Why Debt Over Equity for Expanding Software Ventures?

Many founders are wary of excessive dilution, especially in early and growth stages. Debt financing provides an alternative that can be less expensive in the long run if the company performs well. It’s particularly appealing for companies with predictable recurring revenue, a hallmark of successful SaaS models.

- Maintains founder equity and control

- Often a lower cost of capital compared to equity over time

- Provides flexible funding for operational expenses, R&D, and expansion

- Signals financial maturity to potential investors and partners

The Strategic Advantage of SaaS Debt Funding for Software Businesses

SaaS Capital’s approach focuses on providing growth capital that aligns with the unique subscription-based revenue models of software companies. This specialized understanding allows them to offer tailored financing solutions that traditional banks might not provide.

Key Benefits for Growing Software Businesses:

- Non-Dilutive Capital: Founders avoid giving up ownership stakes, preserving future upside.

- Flexible Terms: Financing structures are often customized to match a SaaS company’s cash flow cycles.

- Accelerated Growth: Funds can be deployed quickly for strategic initiatives like market expansion or new feature development, vital for competitive software markets.

- Bridge to Future Rounds: Debt can serve as a bridge, allowing companies to reach higher valuations before seeking more dilutive equity rounds.

Accessing Capital Without Dilution

One of the most compelling aspects of debt financing for SaaS companies is the ability to secure significant capital without diluting existing shareholders. This is a crucial consideration for founders and early investors who want to maximize their returns as the company grows.

Fueling Expansion and Product Development

Whether it’s investing in a larger sales team, expanding into new geographical markets, or accelerating the development of a groundbreaking new software feature, this type of funding provides the necessary fuel. It empowers companies to act decisively and capitalize on market opportunities.

For more insights into venture debt, you can explore resources like Investopedia’s explanation of venture debt.

Cincinnati’s Role in the Global Software Ecosystem

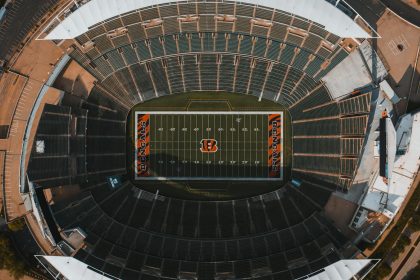

SaaS Capital’s continued success also shines a spotlight on Cincinnati as a burgeoning hub for tech innovation and investment. This local firm’s ability to raise such a substantial fund underscores the growing sophistication and reach of regional investment communities.

A Growing Hub for Tech Investment

The presence of successful firms like SaaS Capital helps to attract further talent and capital to the region, creating a vibrant ecosystem where new software companies can thrive. It’s a testament to the city’s commitment to fostering technological advancement.

Looking Ahead: The Future of Software-as-a-Service Funding

The increasing availability of specialized debt financing for SaaS companies indicates a maturation of the funding landscape. It offers founders more diverse options beyond traditional venture capital, allowing them to choose the funding structure that best suits their strategic goals.

What This Means for the SaaS Landscape

This trend suggests a future where innovative software solutions can find tailored financial support more readily, leading to accelerated development and broader market penetration. It’s an exciting time for anyone involved in the creation and scaling of SaaS products.

To understand the broader market trends influencing SaaS growth, consider reviewing reports from reputable tech market analysis firms, such as Gartner’s software insights.

Conclusion

SaaS Capital’s successful $101 million fund for debt financing is a powerful indicator of the strength and potential within the software-as-a-service sector. By offering a non-dilutive path to growth, this fund empowers founders to maintain control while scaling their innovations. It’s a significant development that will undoubtedly fuel the next wave of disruptive software companies.

Curious how debt financing could accelerate your SaaS venture? Explore the possibilities today!

© 2025 thebossmind.com

SaaS Capital raises $101M for its fifth fund, empowering software-as-a-service companies with…

Fifth Third Profit Grows: Fee Income Soars, But Bankruptcy Costs Hit

### Suggested URL Slug fifth-third-profit-growth ### SEO Title Fifth Third Profit Grows:…

Fifth Third profit jumps on fee income, records $178 million loss from Tricolor bankruptcy | Fifth Third profit jumps on fee income, records $178 million loss from Tricolor bankruptcy. By Reuters. October 17, 20251:41 PM PDTUpdated 18 mins ago.

Fifth Third Bank's Financial Performance Analysis ## Outline Generation Article Outline I.…

Secretary-General’s remarks to the Fifth Committee of the General Assembly on the Proposed Programme Budget for … | I present it in the truly unique context of the UN80 Initiative – driven by a strong sense of urgency and our clear ambition to make the Secretariat more effective, agile, resilient and cost-efficient.

** Discover the transformative UN80 Initiative, a drive for a more effective,…

Huskies Take Fifth at Princeton Fall Classic | PRINCETON, N.J.—UConn women’s cross country performed well on Friday morning at the Princeton Fall Classic. The Huskies finished fifth with 141 points, placing behind Boise State, Princeton, Penn, and Yale. Senior captain Chloe Trudel led the way as …

UConn Cross Country's Top 5 Finish at Princeton UConn Women's Cross Country…

Huskies Take Fifth at Princeton Fall Classic | PRINCETON, N.J.—UConn women’s cross country performed well on Friday morning at the Princeton Fall Classic. The Huskies finished fifth with 141 points, placing behind Boise State, Princeton, Penn, and Yale. Senior captain Chloe Trudel led the way as …

UConn Women's Cross Country Shines at Fall Classic UConn Women's Cross Country…

Huskies Take Fifth at Princeton Fall Classic | PRINCETON, N.J.—UConn women’s cross country performed well on Friday morning at the Princeton Fall Classic. The Huskies finished fifth with 141 points, placing behind Boise State, Princeton, Penn, and Yale. Senior captain Chloe Trudel led the way as …

# **UConn Cross Country's Top Finishes** ## **UConn Cross Country: A Deep…

On Sunday against the Cincinnati Bengals, Golden’s fifth NFL game, a breakout of sorts happened in the best way possible. The first-rounder had three …

**Featured image provided by Pexels — photo by Kelly