1. Pre-Writing Analysis:

Contents

The Peso’s Volatility: Understanding US Intervention and Market ReactionsWhy the Peso’s Value FluctuatesFactors Influencing Peso Exchange RatesUS Intervention and Its Impact on the PesoHow US Dollar Purchases Affect Peso ValuationMarket Indicators: Nondeliverable Forwards ExplainedAnalyzing Recent Peso PerformanceWhat the Forward Prices Tell UsExpert Opinions on Peso TrendsNavigating Currency Markets During Volatile TimesKey Takeaways for Understanding the Peso

Outline Generation:

The Peso’s Volatility: Understanding US Intervention and Market Reactions

Why the Peso’s Value Fluctuates

Introduction to currency markets and the peso’s sensitivity.

Factors Influencing Peso Exchange Rates

- Global economic trends

- Domestic economic policies

- Investor sentiment

US Intervention and Its Impact on the Peso

Exploring the concept of central bank intervention.

How US Dollar Purchases Affect Peso Valuation

Explanation of supply and demand dynamics.

Market Indicators: Nondeliverable Forwards Explained

Understanding how forwards predict future currency movements.

Analyzing Recent Peso Performance

Examining the recent highs and lows of the peso.

What the Forward Prices Tell Us

Interpreting the data from one-month and three-month forwards.

Expert Opinions on Peso Trends

Briefly touching on analyst perspectives.

Navigating Currency Markets During Volatile Times

Strategies for investors and businesses.

Key Takeaways for Understanding the Peso

- Monitor US economic policy.

- Stay informed on local economic indicators.

- Understand market sentiment.

2. Content Creation & SEO Optimization:

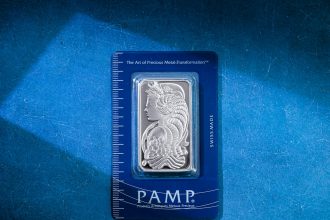

Featured image provided by Pexels — photo by Photo By: Kaboompics.com