bitcoin-tradfi-losses

Bitcoin Faces Banking Woes: What History Predicts

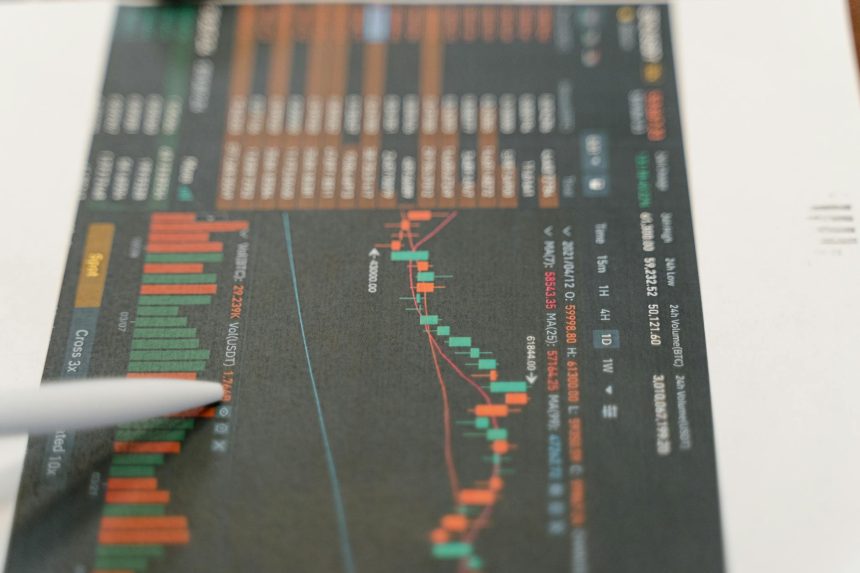

The recent tremors in the traditional finance (TradFi) sector, marked by significant losses for prominent institutions like Jefferies, Zions Bancorp, and Western Alliance, are casting a long shadow over the cryptocurrency market. As Bitcoin slides in tandem with broader financial markets, many are looking to historical precedents to understand the potential trajectory of digital assets. This article delves into the current situation, exploring the impact of these TradFi failures on Bitcoin and what past market cycles can teach us.

## Banking Instability and Bitcoin’s Correlation

The financial press has been abuzz with news of several banks facing substantial financial difficulties. These events, reminiscent of past financial crises, inevitably raise questions about systemic risk and its potential spillover effects. While Bitcoin was once touted as a completely uncorrelated asset, its performance in recent times has shown a surprising degree of correlation with traditional markets, especially during periods of heightened uncertainty.

### Understanding the “Cockroach” Effect in Finance

The term “cockroaches” has emerged in financial commentary to describe the resilient, albeit problematic, entities that seem to survive even the most significant market downturns. In the context of TradFi, these could be institutions with underlying vulnerabilities that become exposed during stress events. The losses incurred by names like Jefferies, Zions Bancorp, and Western Alliance highlight how interconnected the financial system remains.

#### How Bank Failures Impact Digital Assets

When traditional financial institutions falter, it can trigger a cascade of effects:

* **Reduced Liquidity:** A banking crisis can lead to a general tightening of credit and a reduction in available liquidity across all asset classes, including cryptocurrencies.

* **Investor Sentiment:** Fear and uncertainty tend to drive investors away from riskier assets. Bitcoin, despite its growing maturity, is still perceived as a risk-on asset by many.

* **Regulatory Scrutiny:** Major financial disruptions often lead to increased regulatory oversight, which can impact the crypto space as well.

## Historical Parallels: What Past Cycles Tell Us

Examining historical market downturns, particularly those involving banking sector instability, can offer valuable insights into Bitcoin’s potential path forward.

### Lessons from Previous Financial Shocks

Consider the following historical patterns:

1. **2008 Global Financial Crisis:** This event, triggered by the collapse of the housing market and subsequent banking failures, ultimately led to the creation of Bitcoin. While not directly caused by bank failures, the crisis highlighted the flaws in traditional financial systems, paving the way for decentralized alternatives.

2. **Dot-Com Bubble Burst (Early 2000s):** While focused on tech stocks, this period demonstrated how rapid asset inflation followed by a sharp correction could impact investor psychology and capital flows across different markets.

3. **European Sovereign Debt Crisis (Early 2010s):** This period saw significant volatility in global markets as investors grappled with sovereign debt issues. It underscored how interconnectedness could lead to widespread market fear.

### Bitcoin’s Resilience and Evolution

Despite the correlation observed in recent times, it’s crucial to acknowledge Bitcoin’s inherent characteristics and its evolving role in the financial landscape.

* **Decentralization:** Bitcoin’s decentralized nature makes it immune to the specific solvency risks faced by individual banks.

* **Digital Scarcity:** Its fixed supply of 21 million coins offers a hedge against inflation, a concern that often amplifies during times of economic instability.

* **Growing Institutional Adoption:** While current events may cause a temporary pause, the long-term trend of institutional interest in Bitcoin continues.

## The Federal Reserve’s Role and Potential Bullish Catalysts

The response of central banks, particularly the U.S. Federal Reserve, to these banking sector challenges is a critical factor. Historically, aggressive monetary policy interventions, such as interest rate cuts or quantitative easing, have often provided a liquidity boost to financial markets.

### Potential Fed Actions and Their Implications

If the Federal Reserve deems it necessary to inject liquidity to stabilize the financial system, this could have several positive ramifications for Bitcoin:

* **Increased Risk Appetite:** A Fed intervention could signal a return to a more accommodative monetary policy, potentially encouraging investors to seek higher returns in riskier assets like Bitcoin.

* **Inflation Hedge Narrative:** If the Fed’s actions are perceived as inflationary, the appeal of Bitcoin as a store of value and an inflation hedge could strengthen.

* **Reduced Correlation:** As traditional markets stabilize due to Fed action, Bitcoin might begin to decouple once again, exhibiting its unique characteristics.

### What Investors Should Watch For

In the coming weeks and months, investors should closely monitor:

* **Federal Reserve Statements:** Pay attention to any signals regarding monetary policy adjustments.

* **Banking Sector Health:** Track the recovery or further deterioration of affected financial institutions.

* **On-Chain Bitcoin Metrics:** Observe transaction volumes, active addresses, and hodler behavior for signs of underlying network strength.

* **Macroeconomic Indicators:** Monitor inflation data, employment figures, and global economic sentiment.

## Conclusion: Navigating Uncertainty with Historical Wisdom

The current financial climate, marked by TradFi instability and its impact on Bitcoin, presents a complex but not unprecedented scenario. While short-term correlations are evident, history suggests that Bitcoin’s underlying decentralized nature and its potential as a hedge against systemic financial risks remain compelling. The Federal Reserve’s response will be a pivotal factor in shaping market sentiment. By understanding historical patterns and closely monitoring key indicators, investors can better navigate this period of uncertainty and potentially identify opportunities.

© 2025 thebossmind.com

The recent banking sector turmoil, impacting institutions like Jefferies and Western Alliance, is affecting Bitcoin’s price. However, historical market cycles and potential Federal Reserve responses could offer insights into Bitcoin’s future trajectory.

image search value: bitcoin financial crisis, bitcoin banking losses, bitcoin fed response, bitcoin historical market cycles, crypto market volatility

Featured image provided by Pexels — photo by Tima Miroshnichenko