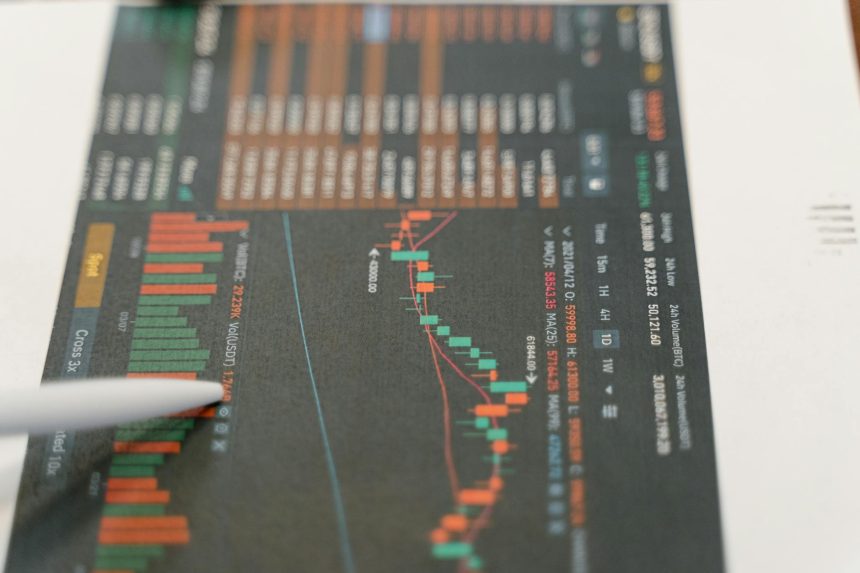

# Crypto & Micro-Cap Stocks: Navigating Volatile Markets

The financial landscape is a constantly shifting terrain, and recent market movements underscore this reality. From the dizzying swings in cryptocurrency to the often-overlooked volatility of micro-cap stocks, investors are facing a complex environment. Understanding these dynamics is crucial for anyone looking to protect their capital and potentially identify opportunities amidst the turbulence. This article delves into the interconnectedness of these market segments, offering insights and strategies for navigating the current climate.

## The Interplay Between Crypto and Traditional Markets

While often viewed as distinct, the cryptocurrency market and traditional stock markets, particularly the realm of micro-cap stocks, are increasingly showing correlations. This is driven by several factors, including:

* **Investor Sentiment:** Broad shifts in investor psychology, influenced by macroeconomic news, geopolitical events, or even social media trends, can impact both crypto and stocks. When fear grips the market, investors may flee to perceived safer assets, leading to sell-offs across the board. Conversely, periods of optimism can fuel speculative buying in both arenas.

* **Liquidity Flows:** As capital moves between different asset classes, it can have ripple effects. Significant inflows into crypto might draw funds away from smaller, more speculative stocks, and vice versa.

* **Technological Adoption:** The underlying technologies that power cryptocurrencies, such as blockchain, are also finding applications in traditional finance. This growing intersection can lead to shared investor interest and influence.

## Micro-Cap Stocks: A High-Risk, High-Reward Frontier

Micro-cap stocks, defined as companies with market capitalizations typically below $300 million, are known for their inherent volatility. They represent some of the smallest publicly traded companies, often in their nascent stages of development. This size and stage contribute to their unique market characteristics:

### Why Micro-Caps Are So Volatile

* **Limited Liquidity:** With fewer shares outstanding and less trading volume, even small buy or sell orders can significantly impact the stock price. This makes them susceptible to rapid price swings.

* **Information Asymmetry:** Detailed information about micro-cap companies can be scarce, leading to greater reliance on speculation and rumor. This can create opportunities for manipulation or unexpected price movements.

* **Growth Potential:** The flip side of high risk is the potential for explosive growth. A successful product launch, a strategic partnership, or a favorable regulatory change can propel a micro-cap stock to new heights.

* **Acquisition Targets:** Smaller companies are often attractive acquisition targets for larger corporations, which can lead to significant price jumps for shareholders.

## Cryptocurrency: The Wild West of Digital Assets

The cryptocurrency market, characterized by Bitcoin, Ethereum, and thousands of altcoins, has captured global attention. Its volatility, however, is legendary.

### Factors Driving Crypto Volatility

* **Speculative Nature:** A significant portion of crypto trading is driven by speculation, with many investors entering the market hoping for rapid gains rather than investing in underlying utility.

* **Regulatory Uncertainty:** The evolving regulatory landscape for cryptocurrencies across different jurisdictions creates constant uncertainty, which can trigger sharp price corrections.

* **Technological Advancements and Shocks:** News related to blockchain technology, new coin launches, or even security breaches can dramatically influence market sentiment and prices.

* **Market Sentiment and Hype:** Social media platforms and online communities can rapidly amplify hype or fear, leading to “pump and dump” schemes or sudden sell-offs.

* **Decentralization:** While a core tenet, the decentralized nature of many cryptocurrencies means there’s no central authority to control supply or intervene during extreme market events, further contributing to price swings.

## Navigating the Storm: Strategies for Investors

Given the inherent risks associated with both micro-cap stocks and cryptocurrencies, a thoughtful and disciplined approach is essential. Here are some strategies to consider:

### For Micro-Cap Stock Investors

1. **Thorough Due Diligence:** This is paramount. Research the company’s fundamentals, management team, competitive landscape, and growth prospects. Look for companies with clear business models and a path to profitability.

2. **Diversification:** Never put all your eggs in one basket. Spread your investments across multiple micro-cap companies to mitigate the impact of any single company’s failure.

3. **Long-Term Perspective:** Micro-cap investing is often best approached with a long-term outlook. Avoid chasing short-term gains, as this can lead to impulsive and costly decisions.

4. **Understand Your Risk Tolerance:** Be honest with yourself about how much risk you can comfortably take. Micro-caps are not suitable for risk-averse investors.

5. **Monitor Your Holdings:** Stay informed about the companies you’ve invested in and the broader market conditions.

### For Cryptocurrency Investors

1. **Invest Only What You Can Afford to Lose:** This is the golden rule of crypto investing. The market is highly speculative, and significant losses are possible.

2. **Educate Yourself:** Understand the technology behind the cryptocurrencies you’re interested in, their use cases, and the risks involved.

3. **Choose Reputable Exchanges and Wallets:** Security is critical. Use well-established platforms and secure storage solutions for your digital assets.

4. **Dollar-Cost Averaging (DCA):** Consider investing a fixed amount of money at regular intervals, regardless of the price. This can help average out your purchase price over time and reduce the impact of market volatility.

5. **Be Wary of Hype:** Resist the urge to jump into investments based solely on social media trends or promises of quick riches.

## The Broader Market Takeaways

The convergence of volatility in micro-cap stocks and cryptocurrencies serves as a significant market takeaway. It highlights:

* **The increasing interconnectedness of financial markets:** Investors can no longer afford to view asset classes in isolation.

* **The importance of risk management:** In an environment of heightened uncertainty, robust risk management strategies are more critical than ever.

* **The enduring allure of speculative assets:** Despite the risks, the potential for outsized returns continues to draw investors to both micro-caps and crypto.

* **The need for informed decision-making:** Success in these markets hinges on research, discipline, and a clear understanding of the risks involved.

As the financial world continues to evolve, staying informed and adaptable will be key. Whether you’re exploring the potential of emerging companies in the stock market or the decentralized future of digital assets, a grounded and strategic approach will serve you best.

***

*Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.*

Copyright 2025 thebossmind.com

Source 1: [https://www.sec.gov/oiea/investor-alerts-and-bulletins/microcap-stocks](https://www.sec.gov/oiea/investor-alerts-and-bulletins/microcap-stocks)

Source 2: [https://www.investopedia.com/terms/c/cryptocurrency.asp](https://www.investopedia.com/terms/c/cryptocurrency.asp)

Featured image provided by Pexels — photo by Tima Miroshnichenko