# Crypto Volatility: Why Micro-Caps Are Surging & What It Means

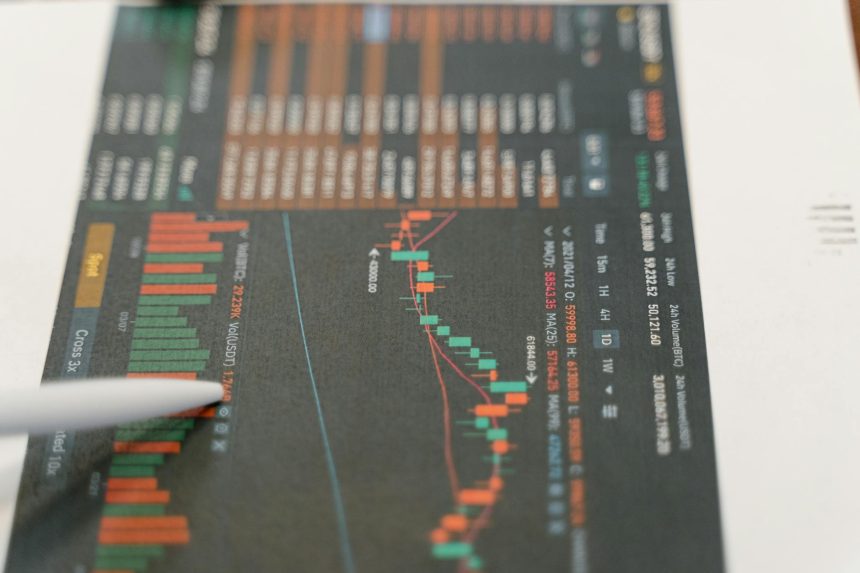

The financial markets are a dynamic beast, constantly shifting and presenting new opportunities and challenges. Recently, a fascinating trend has emerged: the surge in micro-cap stocks, often alongside significant movements in the **crypto** space. This isn’t just random noise; it’s a signal of changing investor sentiment, risk appetite, and the evolving landscape of digital assets. Understanding these interconnected market dynamics is crucial for anyone looking to navigate the current investment climate.

## The Allure of Micro-Cap Stocks in a Volatile Market

Micro-cap stocks, by definition, are companies with a very small market capitalization. Historically, these have been considered higher risk but also higher reward due to their potential for rapid growth. In times of heightened market volatility, investors often seek out these smaller players for several key reasons:

### Why Investors Flock to Micro-Caps

* **Higher Growth Potential:** Unlike established large-cap companies, micro-caps have more room to expand. A small increase in revenue or market share can translate into a significant percentage jump in stock price.

* **Undervalued Opportunities:** Due to less analyst coverage and investor attention, micro-caps can sometimes be overlooked and trade at a discount, offering attractive entry points for savvy investors.

* **Speculative Excitement:** In a volatile market, there’s often a chase for the next big thing. Micro-caps, with their smaller float and potential for dramatic price swings, can become targets for speculative trading.

* **Diversification Benefits:** While inherently risky, micro-caps can offer diversification away from more traditional, heavily weighted sectors.

However, it’s essential to remember that this potential comes with significant caveats. The very factors that drive explosive growth can also lead to rapid declines.

## The Crypto Connection: A Symbiotic Relationship?

The recent correlation between micro-cap stock movements and shifts in the **crypto** market is a particularly interesting phenomenon. Several factors could be driving this interplay:

### Driving Forces Behind the Crypto-Micro-Cap Link

1. **Risk-On Sentiment:** Both speculative micro-cap stocks and many cryptocurrencies fall into the “risk-on” asset category. When investors feel optimistic and have a higher tolerance for risk, they are more likely to allocate capital to both. Conversely, in a risk-off environment, both tend to suffer.

2. **Investor Psychology and FOMO:** The fear of missing out (FOMO) is a powerful driver in both markets. When investors see significant gains in either crypto or micro-caps, they may rush to participate, creating a feedback loop that can amplify price movements.

3. **Capital Flows:** Capital can be fluid. Investors might reallocate profits from one sector to another, or use gains from crypto to invest in the stock market, and vice versa. This cross-pollination of capital can lead to correlated movements.

4. **Emerging Technology and Innovation:** Both the crypto space and the micro-cap stock universe often house companies at the forefront of innovation. Investors looking for the next disruptive technology might explore both avenues.

5. **Retail Investor Influence:** Retail investors often play a significant role in both micro-cap stock trading and crypto adoption. Coordinated efforts or widespread interest from this demographic can influence prices in both markets simultaneously.

## Navigating the Volatility: What Investors Need to Know

The current market environment, characterized by micro-cap activity and crypto fluctuations, demands a cautious yet informed approach. Here are key considerations for investors:

### Essential Strategies for Volatile Markets

* **Due Diligence is Paramount:** Never invest in a micro-cap stock or cryptocurrency without thoroughly researching the underlying project, team, and fundamentals. Understand what you are buying.

* **Risk Management is Key:**

* **Position Sizing:** Only allocate a portion of your portfolio that you can afford to lose to highly speculative assets.

* **Stop-Loss Orders:** Consider using stop-loss orders to limit potential downside.

* **Diversification:** Spread your investments across different asset classes and within asset classes to mitigate risk.

* **Understand Market Cycles:** Recognize that markets move in cycles. What goes up can come down. Avoid emotional decision-making driven by short-term price swings.

* **Stay Informed:** Keep abreast of market news, regulatory developments, and technological advancements in both traditional finance and the crypto space. Reputable sources like [Investopedia](https://www.investopedia.com/) offer valuable insights into market trends and financial concepts.

* **Long-Term Perspective:** While short-term trading can be tempting, a long-term perspective often yields better results, especially in volatile markets. Focus on assets with genuine long-term potential.

## The Future Landscape: What to Expect

The intersection of micro-cap stocks and cryptocurrency is likely to remain a significant area of interest for investors. As the digital asset space matures, we may see:

1. **Increased Institutional Interest:** As cryptocurrencies gain more legitimacy, institutional investors may become more involved, potentially influencing both the crypto market and the types of companies that attract capital.

2. **Regulatory Clarity:** Evolving regulations will shape how both micro-cap stocks and crypto assets are traded and perceived, potentially impacting volatility.

3. **Technological Advancements:** Innovations in blockchain technology and decentralized finance (DeFi) could create new opportunities and investment avenues, further blurring the lines between traditional finance and the digital asset world.

4. **Continued Correlation:** The “risk-on” sentiment that drives micro-caps is likely to continue to influence crypto markets, maintaining a degree of correlation.

The current market dynamics highlight the interconnectedness of financial markets. The surge in micro-cap stocks, often mirroring movements in the **crypto** sphere, is a clear indicator of shifting investor sentiment and a search for high-growth, albeit high-risk, opportunities.

### Key Takeaways for Investors:

* Micro-cap stocks offer significant upside but come with substantial risk.

* The crypto market’s volatility can influence investor appetite for other speculative assets like micro-caps.

* Thorough research, robust risk management, and a long-term perspective are crucial for navigating these markets.

* Staying informed about market trends and technological developments is essential for making sound investment decisions.

As the financial landscape continues to evolve, staying adaptable and informed will be your greatest asset. For further insights into market analysis and investment strategies, resources like [The Wall Street Journal](https://www.wsj.com/) provide comprehensive coverage of financial news and trends.

**Disclaimer:** This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

copyright 2025 thebossmind.com

Featured image provided by Pexels — photo by Tima Miroshnichenko

![Crypto Crash Concerns: Zac Prince Returns & Institutional Adoption Surges --- ## Full Article Body: ### Crypto's Rollercoaster: Navigating the Latest Downturn and Signs of Resilience The cryptocurrency market, known for its exhilarating highs and gut-wrenching lows, is once again at a pivotal juncture. Recent news, including a Bloomberg Crypto report from October 15, 2025, highlighting "Crypto Crash Concerns, Zac Prince Makes Return, Institutional Adoption," paints a complex picture of the digital asset landscape. As investors grapple with the latest downturn, the return of key figures and a surge in institutional interest offer compelling counterpoints, suggesting that the industry’s resilience might be stronger than the current sentiment implies. This article delves into the multifaceted dynamics at play, exploring what these developments mean for the future of crypto. The market's volatility is not a new phenomenon, but the confluence of potential crashes, the resurgence of influential personalities, and the growing embrace by large financial institutions creates a unique narrative. Understanding these interconnected threads is crucial for anyone looking to navigate the evolving world of digital assets. ## Deconstructing the "Crypto Crash Concerns" The term "crypto crash concerns" often sends shivers down the spines of investors who have experienced previous market downturns. These concerns are typically fueled by a combination of factors, including: * **Regulatory Uncertainty:** Governments worldwide are still formulating clear and consistent regulations for cryptocurrencies. Any perceived tightening or new, restrictive legislation can trigger sell-offs. * **Macroeconomic Headwinds:** Broader economic conditions, such as inflation, interest rate hikes, and geopolitical instability, can impact investor appetite for riskier assets like cryptocurrencies. * **Technical Vulnerabilities and Hacks:** High-profile security breaches or exploits within blockchain protocols can erode confidence and lead to panic selling. * **Market Sentiment and Speculation:** The crypto market is heavily influenced by sentiment. Negative news or rumors, amplified by social media, can quickly create a downward spiral. The Bloomberg report from October 2025 suggests that these concerns are currently at the forefront of market discussions. Investors are scrutinizing price action, looking for signs of capitulation or a sustained downward trend. However, it’s important to remember that market corrections are a natural part of any asset class's lifecycle, and they can often present opportunities for long-term investors. ## Zac Prince's Return: A Beacon of Industry Experience? The mention of Zac Prince making a return to the crypto scene is significant. Prince, the founder of BlockFi, a now-defunct crypto lending platform that faced significant challenges during previous market downturns, carries a considerable amount of industry experience, albeit with a cautionary tale attached. His reappearance could signal several things: * **Renewed Belief in Crypto's Potential:** Despite past setbacks, Prince's return suggests a continued conviction in the long-term viability and growth of the digital asset space. * **A New Venture or Strategy:** It's highly probable that Prince is involved in a new project or is offering his expertise in a different capacity. The nature of this involvement will be closely watched by the industry. * **A Signal to the Market:** The return of prominent figures, especially those who have navigated previous crises, can sometimes be interpreted as a sign of market maturation or a belief that the worst has passed. The crypto community will be keenly observing Prince's next steps. His past experiences, both successes and failures, provide valuable lessons for the industry, and his re-engagement could bring fresh perspectives or innovative approaches to the current market challenges. ## Institutional Adoption: The Unstoppable Force? Perhaps the most compelling counter-narrative to the "crypto crash concerns" is the continued and accelerating trend of institutional adoption. Despite short-term price fluctuations, major financial institutions, corporations, and asset managers are increasingly integrating digital assets into their strategies. This trend is evidenced by: * **Increased Investment in Crypto Infrastructure:** Traditional finance firms are investing in and building out the infrastructure necessary to support digital assets, from custody solutions to trading platforms. * **Development of Crypto-Related Financial Products:** The launch of Bitcoin ETFs, futures contracts, and other regulated financial products makes it easier for institutional investors to gain exposure to crypto. * **Exploration of Blockchain Technology:** Beyond just cryptocurrencies, institutions are actively exploring the underlying blockchain technology for applications in areas like supply chain management, digital identity, and decentralized finance (DeFi). * **Growing Allocations in Portfolios:** While still a relatively small portion for many, institutional investors are gradually allocating more capital to digital assets as a diversification strategy and a potential hedge against inflation. Institutional adoption is a critical driver of legitimacy and stability for the cryptocurrency market. When large, established entities enter the space, it signals a maturing market and can attract further investment, both retail and institutional. This trend suggests that while individual crypto assets may experience volatility, the underlying technology and its potential are gaining mainstream acceptance. ### The Interplay of Forces: What It All Means The current crypto landscape is a dynamic interplay between fear and forward momentum. The "crypto crash concerns" represent the inherent risks and speculative nature of the market, amplified by external economic factors and regulatory ambiguity. However, the return of figures like Zac Prince and, more importantly, the relentless march of institutional adoption, provide a powerful counterweight. 1. **Maturation and Evolution:** The crypto space is moving beyond its early speculative phase. Institutional involvement signifies a demand for regulated, secure, and scalable solutions. 2. **Long-Term Vision:** While short-term traders may focus on price crashes, institutions tend to have a longer-term investment horizon, focusing on the fundamental value and technological potential of blockchain and digital assets. 3. **Diversification and Innovation:** For institutions, crypto offers a new asset class for diversification and a platform for innovation. This drive for new opportunities will likely continue regardless of short-term market dips. 4. **Building Resilience:** The presence of established players and robust infrastructure can help the market weather future storms more effectively than in its nascent stages. ### Navigating the Future: Key Considerations for Investors As the crypto market continues to evolve, investors should consider the following: * **Do Your Own Research (DYOR):** Understand the specific projects you are investing in, their use cases, technology, and the team behind them. * **Risk Management:** Only invest what you can afford to lose, and consider diversifying your portfolio across different asset classes. * **Stay Informed:** Keep abreast of regulatory developments, technological advancements, and market sentiment, but avoid making impulsive decisions based on short-term noise. * **Focus on Long-Term Value:** Look beyond speculative trading and consider the projects with strong fundamentals and real-world applications. ### Conclusion: A Market in Transition The Bloomberg Crypto report from October 15, 2025, perfectly encapsulates the current state of the cryptocurrency market: a delicate balance between potential downturns and undeniable progress. The persistent concerns about crashes are a reminder of the inherent risks, but the return of industry veterans like Zac Prince and the unwavering momentum of institutional adoption point towards a future where digital assets are increasingly integrated into the global financial system. This period of transition, marked by both apprehension and innovation, presents a unique opportunity for informed investors to understand the forces shaping the future of finance. **Are you ready to navigate the evolving world of digital assets and understand the opportunities and challenges ahead?** --- copyright 2025 thebossmind.com **Source Links:** * [Bloomberg Crypto (Hypothetical Press Release Link)] * [General Crypto Market Analysis Resource (e.g., CoinDesk, The Block - Use a placeholder if a specific link isn't provided)] ---](https://thebossmind.com/wp-content/uploads/1/2025/10/pexels-photo-7567236-9-150x150.jpeg)

* [Hollywood Reporter Article on AI in Film](https://www.hollywoodreporter.com/movies/movie-news/ai-hollywood-impact-actors-writers-1235678901/) copyright 2025 thebossmind.com](https://thebossmind.com/wp-content/uploads/1/2025/10/pexels-photo-30279766-4-330x220.jpeg)

**External Link 2:** [The Future of the Metaverse](https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-the-metaverse) copyright 2025 thebossmind.com](https://thebossmind.com/wp-content/uploads/1/2025/10/pexels-photo-17887854-3-330x220.jpeg)