bitcoin trading interest

Bitcoin Trading Interest Skyrockets: What It Means for Investors

Bitcoin Trading Interest Skyrockets: What It Means for Investors

The digital asset landscape is buzzing with renewed energy, and a significant surge in Bitcoin trading interest is at the forefront of this excitement. Investors are not just curious; they’re actively engaging with cryptocurrencies like never before. This growing fascination begs the question: what’s driving this trend, and how can individuals best navigate this evolving market?

Understanding the Surge in Bitcoin Trading Interest

Several factors are contributing to the heightened investor attention towards Bitcoin. The increasing maturity of the cryptocurrency market, coupled with a growing institutional acceptance, has paved the way for more mainstream participation. Furthermore, recent market movements and the potential for significant returns continue to attract both seasoned traders and newcomers alike.

Why Now? Key Drivers of Increased Activity

- Institutional Adoption: Major financial players are increasingly exploring and integrating digital assets into their offerings, signaling a growing legitimacy.

- Market Volatility & Potential Returns: The inherent volatility of Bitcoin, while a risk, also presents opportunities for substantial gains, attracting speculative interest.

- Technological Advancements: Ongoing developments in blockchain technology and the broader crypto ecosystem enhance usability and security.

- Growing Investor Awareness: As more information becomes readily available, a broader audience is understanding the potential of digital currencies.

The Impact of Growing Bitcoin Trading Interest

This significant uptick in Bitcoin trading interest has tangible implications for both individual investors and the financial industry at large. Financial institutions are taking notice and adapting their strategies to meet client demand.

What Financial Giants Are Doing

Leading financial services firms are recognizing the shift. Many are enhancing their digital asset platforms and considering the integration of cryptocurrency trading into their services. This strategic pivot reflects a proactive approach to cater to a clientele that is increasingly diversifing their investment portfolios beyond traditional assets.

For instance, some of the largest brokerage firms are reporting substantial increases in client engagement with digital currencies. This suggests a broader trend of wealth management providers looking to offer more comprehensive investment solutions that include exposure to the crypto market.

Navigating the Opportunities

For individual investors, this growing interest means more resources and potentially more accessible platforms for engaging with Bitcoin. However, it also underscores the importance of thorough research and a well-defined investment strategy.

- Educate Yourself: Understand the fundamentals of Bitcoin, blockchain technology, and the risks involved.

- Assess Your Risk Tolerance: Cryptocurrencies are volatile. Only invest what you can afford to lose.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket.

- Choose Reputable Platforms: Use well-established and secure exchanges and trading platforms.

The evolving landscape also brings opportunities for innovation. As demand grows, we can expect to see more sophisticated trading tools and investment products emerge, catering to a wider range of investor sophistication. This increased competition among service providers could lead to better user experiences and potentially lower fees.

Looking Ahead: The Future of Bitcoin Trading

The consistent rise in Bitcoin trading interest signals a maturing digital asset market. As more traditional financial institutions embrace this asset class, it’s likely to further legitimize cryptocurrencies and potentially lead to greater stability and wider adoption. Staying informed about market trends and regulatory developments will be crucial for anyone looking to participate effectively.

The journey of Bitcoin and other digital assets is still unfolding. By understanding the current trends and preparing accordingly, investors can position themselves to potentially benefit from the future of finance.

For more insights into navigating the cryptocurrency market, consider exploring resources like the U.S. Securities and Exchange Commission’s investor guidance on crypto assets or the FINRA investor education on cryptocurrencies.

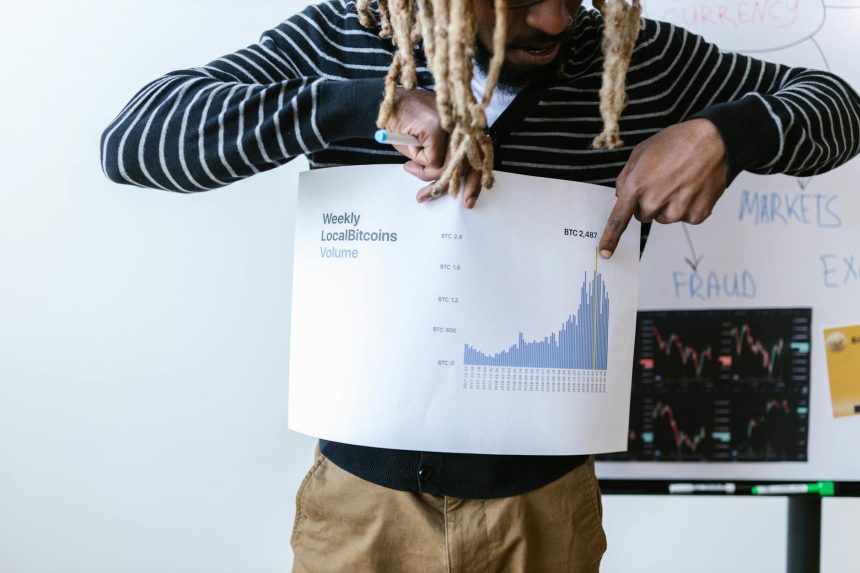

Featured image provided by Pexels — photo by RDNE Stock project