bitcoin-price-analysis-signals-support

Bitcoin Price Analysis: 3 Key Signals & What Happens Next?

Are you watching the crypto market with bated breath, wondering about Bitcoin’s next move? The world of digital assets is dynamic, and understanding its pulse requires a keen eye on various indicators. This comprehensive Bitcoin price analysis dives into recent market signals, historical patterns, and expert opinions to help you navigate the current landscape. We’ll explore critical technical indicators and significant support levels that could dictate Bitcoin’s trajectory.

Understanding Key Bitcoin Price Indicators

To truly grasp Bitcoin’s market movements, it’s essential to look beyond the daily charts and consider the underlying technical signals. These indicators provide valuable insights into market sentiment and potential future trends.

The RSI: Unpacking Oversold Signals

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Typically, an asset is considered “oversold” when its RSI dips below 30, suggesting that the price decline may be overdone and a bounce could be imminent. Recently, Bitcoin’s RSI flashed such an oversold signal, a development that often catches the attention of traders looking for potential entry points. However, it’s crucial to remember that oversold conditions can persist, especially in strong downtrends.

- RSI below 30 often indicates an asset is oversold.

- Can signal a potential reversal or bounce.

- Not a standalone indicator; context is vital.

Moving Averages: A Historical Anchor

Moving averages smooth out price data over a specific period, helping to identify trend direction. The 50-week moving average (WMA) is particularly significant for Bitcoin, often acting as a crucial historical support level during market corrections. When Bitcoin’s price approaches or touches this average, it frequently finds a floor, demonstrating its importance as a psychological and technical benchmark for long-term investors. Understanding how these historical support levels have performed in the past can offer valuable context for current price action. You can learn more about moving averages on Investopedia.

Bitcoin Price Analysis: Navigating Current Market Volatility

Bitcoin’s journey is rarely a smooth one. Recent price slides have pushed the digital asset below several key levels, prompting both concern and opportunity among market participants. A detailed Bitcoin price analysis requires examining these critical junctures.

Recent Price Action and Critical Levels

The cryptocurrency market has experienced significant volatility, with Bitcoin’s price sliding below important short-term support zones. This downward pressure has led many to re-evaluate their positions and look for stronger foundations. Breaking below key technical levels can trigger further selling, but it also often leads to the testing of more robust, long-term support structures.

The Significance of Historical Support

Despite recent declines, Bitcoin has consistently found historical support at the 50-week moving average. This pattern suggests that even in bearish phases, there are underlying levels where buying interest tends to re-emerge. Understanding this historical tendency helps in evaluating the potential for a rebound. It’s a testament to the resilience Bitcoin has shown across multiple market cycles.

- The 50-WMA has acted as a strong support in previous bear markets.

- Psychological importance for long-term holders and institutional investors.

- A break below could signal deeper corrections, but a hold often precedes recovery.

Expert Perspectives on Bitcoin’s Future

The current market sentiment around Bitcoin is, as expected, divided. Analysts often offer contrasting views, reflecting the inherent uncertainty and speculative nature of cryptocurrency. This divergence highlights the complexity of forecasting future price movements.

Divergent Views: Bullish vs. Bearish Arguments

Some analysts remain bullish, citing the oversold RSI, the historical support at the 50-week moving average, and growing institutional adoption as reasons for an impending recovery. They believe the current dip is a healthy correction within a larger uptrend. Conversely, bearish analysts point to macroeconomic headwinds, potential regulatory pressures, and continued selling pressure as reasons for further downside. Their outlook suggests that Bitcoin may need to consolidate longer before a sustainable rally can begin.

Key Factors for Traders and Investors to Monitor

Regardless of the prevailing sentiment, several factors warrant close attention. Macroeconomic data, such as inflation reports and interest rate decisions, can significantly impact risk-on assets like Bitcoin. Furthermore, on-chain metrics, regulatory news, and major developments within the broader crypto ecosystem will continue to influence its trajectory. Keeping an eye on these elements is crucial for informed decision-making. For a deeper dive into crypto market data, CoinMarketCap is an excellent resource.

Strategies for Navigating the Bitcoin Market

Given the mixed signals and expert opinions, how should investors and traders approach the current Bitcoin market? Prudent strategies focus on risk management and understanding one’s investment horizon.

Prudent Risk Management Approaches

In volatile markets, effective risk management is paramount. This includes setting stop-losses, diversifying portfolios, and only investing capital you can afford to lose. Avoid making emotional decisions based on short-term price swings. Instead, rely on a well-thought-out investment plan that considers your personal financial goals and risk tolerance.

Considering Long-Term vs. Short-Term Bitcoin Outlooks

For long-term investors, current dips might be viewed as accumulation opportunities, especially if they believe in Bitcoin’s fundamental value and future adoption. Short-term traders, on the other hand, might focus on identifying quick bounces from support levels or shorting resistance. Your approach should align with your investment strategy and time horizon.

In conclusion, the recent Bitcoin price analysis reveals a market at a crossroads. While the RSI indicates oversold conditions and the 50-week moving average provides historical support, analysts remain split on the immediate future. Understanding these technical signals and considering diverse expert opinions is key to navigating Bitcoin’s inherent volatility. Whether you’re a long-term holder or an active trader, staying informed and adopting a disciplined approach is crucial for success in the dynamic crypto landscape.

Stay informed and make data-driven decisions by subscribing to our newsletter for the latest market insights.

Dive into our comprehensive Bitcoin price analysis, exploring oversold RSI signals, historical moving average support, and expert opinions. Understand key levels and what’s next for BTC.

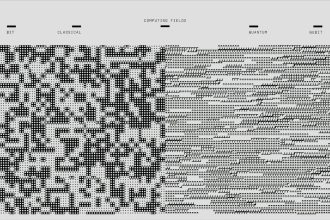

Bitcoin price analysis chart with RSI and 50-week moving average lines, showing historical support.