Bitcoin Price Analysis: 3 Critical Signals & What’s Next for BTC?

The world of cryptocurrency is a constant flurry of activity, and few assets capture attention quite like Bitcoin. Recent market movements have left many investors and enthusiasts scrutinizing charts, seeking clarity amidst volatility. Is Bitcoin poised for a rebound, or are further corrections on the horizon? This comprehensive Bitcoin price analysis delves into key technical indicators and historical patterns to help you understand the current landscape and what might be next for BTC.

Bitcoin Price Analysis: Understanding Key Indicators

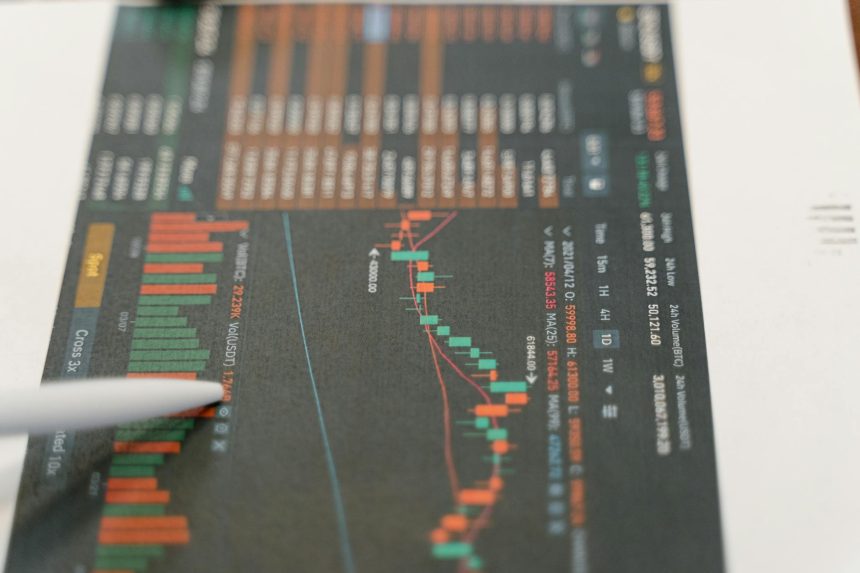

Navigating the complex world of digital assets requires a keen eye on technical indicators. These tools provide valuable insights into market sentiment and potential future price movements. Two crucial indicators currently shaping the narrative around Bitcoin are the Relative Strength Index (RSI) and significant support levels.

The Relative Strength Index (RSI): What Does “Oversold” Mean?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Ranging from 0 to 100, it helps identify overbought or oversold conditions in an asset. When the RSI dips below 30, it traditionally signals that an asset is “oversold,” suggesting that the recent price drop may have been too aggressive and a rebound could be imminent. This signal often attracts bargain hunters looking for potential entry points.

However, an oversold RSI isn’t a guaranteed buy signal. Prices can remain in oversold territory for extended periods during strong downtrends. Therefore, it’s crucial to consider this indicator in conjunction with others to form a more robust trading strategy. Understanding the nuances of the RSI is fundamental for any serious Bitcoin price analysis.

Navigating Support and Resistance Levels

Support and resistance levels are foundational concepts in technical analysis. A support level is a price point where buying interest is strong enough to prevent the price from falling further, at least temporarily. Conversely, a resistance level is a price point where selling interest is strong enough to prevent the price from rising higher. Identifying these key levels can provide traders with crucial insights into potential turning points and areas of consolidation. When Bitcoin’s price slides below established support, it often signals a shift in market sentiment and can pave the way for further declines until new support is found.

Historical Patterns: Bitcoin’s 50-Week Moving Average

History doesn’t repeat itself exactly, but it often rhymes. For long-term investors and analysts, examining historical price patterns can offer valuable context for current market conditions. One particularly significant historical indicator for Bitcoin has been its 50-week moving average.

Decoding the 50-Week MA as a Support Zone

The 50-week moving average (MA) is a widely watched technical indicator that smooths out price data over the past 50 weeks, providing a clearer picture of the long-term trend. Historically, Bitcoin has often found robust support at this crucial moving average during periods of price correction. When the price dips to or slightly below the 50-week MA and then bounces, it’s frequently interpreted as a sign of underlying strength and a potential bottoming out for that particular cycle. This pattern has served as a reliable indicator for many market participants over the years.

Past Performance vs. Future Potential

While the 50-week moving average has historically acted as a strong support zone for Bitcoin, it’s vital to remember that past performance is not indicative of future results. Market dynamics evolve, and new factors can influence price action. Investors should view historical patterns as a guide, not a guarantee, and always conduct their own due diligence. Combining historical context with current market data offers a more complete picture for a thorough Bitcoin price analysis.

Market Sentiment & Analyst Perspectives on Bitcoin’s Trajectory

Beyond technical charts, the collective mood of the market and the opinions of leading analysts play a significant role in Bitcoin’s price movements. Understanding these qualitative factors can provide an edge in anticipating future trends.

Why Analysts Are Split: Factors Influencing Divergent Views

Currently, the analyst community finds itself divided on Bitcoin’s immediate future. This split isn’t uncommon during periods of uncertainty and can be attributed to several factors:

- Macroeconomic Headwinds: Global inflation, interest rate hikes, and geopolitical tensions can weigh on risk assets like Bitcoin.

- Regulatory Landscape: Evolving regulations in different jurisdictions introduce both opportunities and uncertainties.

- On-Chain Data Interpretation: Different analysts may interpret the same on-chain metrics (e.g., exchange flows, miner behavior) in varied ways.

- Technical Indicator Emphasis: Some analysts may prioritize short-term indicators, while others focus on long-term trends, leading to differing conclusions.

This divergence highlights the inherent complexity of predicting asset prices and underscores the importance of considering multiple perspectives.

Key Takeaways for Investors

For investors, the current environment demands a balanced approach. It’s crucial to:

- Diversify Portfolios: Don’t put all your eggs in one basket; spread investments across various assets.

- Stay Informed: Continuously monitor market news, technical developments, and expert opinions.

- Define Your Risk Tolerance: Understand how much volatility you can comfortably handle.

- Have a Long-Term Strategy: Avoid impulsive decisions based on short-term price swings.

- Utilize Stop-Loss Orders: Protect your capital by setting predefined exit points for trades.

For further reading on technical analysis, consider exploring resources like Investopedia’s guide to technical analysis.

Strategies for Navigating Bitcoin Volatility

Bitcoin’s notorious volatility can be a double-edged sword, presenting both significant opportunities and substantial risks. Employing smart strategies is essential for thriving in such an environment.

Technical Indicators to Watch

- Moving Average Convergence Divergence (MACD): Identifies trend changes and momentum.

- Bollinger Bands: Measures market volatility and potential overbought/oversold conditions.

- Volume: Confirms the strength of price movements; high volume often accompanies significant moves.

- Fibonacci Retracements: Identifies potential support and resistance levels based on percentage retracements.

Risk Management Principles

Effective risk management is paramount in crypto trading. Consider these principles:

- Position Sizing: Only allocate a small percentage of your total capital to any single trade.

- Stop-Loss Orders: Automatically close a trade if the price moves against you beyond a certain point.

- Profit Taking: Secure gains by selling a portion of your holdings when targets are met.

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly, regardless of price, to reduce average cost over time.

For more insights into current market data, a reputable source like CoinMarketCap’s Bitcoin page can be invaluable.

In conclusion, the current Bitcoin price analysis reveals a market at a crossroads. While the RSI flashes oversold signals and historical patterns point to the 50-week moving average as a significant support, analyst opinions remain split. Navigating this complex environment requires a blend of technical understanding, historical context, and a keen awareness of market sentiment. Stay informed, apply sound risk management, and make data-driven decisions to navigate Bitcoin’s future effectively.

Dive deep into Bitcoin Price Analysis, exploring RSI oversold signals, historical 50-week moving average support, and expert market sentiment. Uncover key insights for navigating BTC’s future.